Collision repair insurance deductibles are out-of-pocket expenses that policyholders must pay before insurance covers vehicle repairs, encouraging responsible driving and cost-consciousness. Deductibles activate based on factors like fault, damage severity, and repair type (cosmetic vs. substantial). Understanding these conditions helps policyholders make informed decisions about filing claims and reviewing their coverage, especially after life events or new purchases, to ensure adequate collision repair insurance tailored to their needs.

Collision repair insurance plans offer crucial financial protection for unforeseen vehicle damages. Understanding deductibles, those out-of-pocket costs before insurance coverage kicks in, is essential in navigating collision repairs. This article demystifies deductibles, exploring when they apply in various scenarios and providing tips for policyholders to optimize their coverage. By grasping these concepts, folks can make informed decisions, ensuring their collision repair process remains as smooth as possible.

- Understanding Deductibles: What They Are and How They Work

- When Deductibles Apply: Scenarios and Conditions

- Navigating Collision Repair Costs: Tips for Policyholders

Understanding Deductibles: What They Are and How They Work

Deductibles are a fundamental aspect of collision repair insurance plans, serving as a financial safeguard for both insurers and policyholders. When a vehicle incurs damages requiring repair, the deductible is the out-of-pocket expense the policyholder must cover before the insurance provider steps in to reimburse the rest. This self-insurance component encourages responsible driving behavior by making individuals more conscious of their actions behind the wheel.

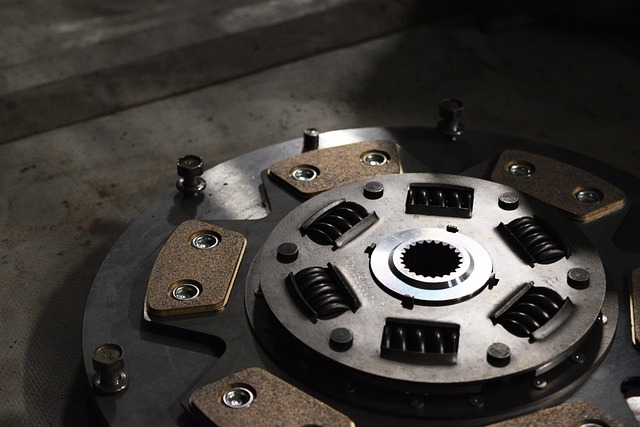

Understanding deductibles is crucial for anyone considering collision repair insurance. They work by setting a specific amount, usually a predetermined dollar value or a percentage of the vehicle’s value, that must be paid before coverage kicks in. For instance, if your collision repair insurance has a $500 deductible and your car suffers damages totaling $3,000, you’ll pay the initial $500 out-of-pocket while the remaining $2,500 is covered by your insurance provider. This system promotes cost-consciousness in vehicle maintenance and repairs, with policyholders taking responsibility for smaller but significant expenses like deductibles, while relying on their collision repair insurance for more substantial costs related to auto frame repair or vehicle restoration at a vehicle body shop.

When Deductibles Apply: Scenarios and Conditions

When deductibles apply in collision repair insurance plans depends on various scenarios and conditions. In general, a deductible is a pre-set amount that policyholders must pay out of pocket before their insurance covers the rest of the repair costs. This means if your car experiences a collision and the damage falls within your deductible threshold, you’ll be responsible for paying this amount directly to the repair shop or body shop.

Consider a few common situations where deductibles come into play: if you’re at fault in an accident, if your vehicle sustains minor dents or scratches that fall below the deductible threshold, or if you choose to file a claim for cosmetic repairs like car scratch repair or vehicle dent repair rather than more substantial auto body restoration. Understanding these conditions can help policyholders make informed decisions about when to file a claim and whether it’s financially prudent to cover the deductible themselves.

Navigating Collision Repair Costs: Tips for Policyholders

Navigating Collision Repair Costs: Tips for Policyholders

When a collision occurs, understanding your collision repair insurance coverage is crucial. As policyholders, it’s essential to be aware of the deductibles applied to these plans and how they impact vehicle repair services. Deductibles are the amount you must pay out-of-pocket before insurance covers the rest of the repair costs. Knowing this upfront can help you budget effectively.

When comparing collision coverage, consider both the deductible amount and the potential savings on vehicle dent repair or car paint repair. Opting for a higher deductible might result in lower premiums, but ensure it aligns with your financial comfort level. Regularly reviewing your policy and deductibles is wise, especially after significant life events or when considering new vehicle purchases, to make certain you have the best coverage for your needs.

Collision repair insurance deductibles play a significant role in managing costs, ensuring that policyholders are actively involved in the claims process. By understanding when deductibles apply and how they impact collision repair expenses, individuals can make informed decisions and effectively navigate their insurance coverage. This knowledge empowers policyholders to choose plans that align with their needs and budget while still providing adequate protection for unexpected collision repairs.