Collision repair insurance denials can be confusing but are often due to deviations from established guidelines, such as faulty diagnostics or non-original parts. By understanding the reasons behind denials and clarifying myths about certified/aftermarket parts and frame straightening, car owners and repair shops can navigate claims effectively, reducing stress and ensuring quality work. The appeals process involves reviewing denial notices, gathering documents, writing a detailed letter, and submitting through proper channels; deadlines should be adhered to. For denied claims, alternatives include self-funding repairs, third-party facilities, mobile services, and online platforms that connect users with local experts without relying on insurance.

Collision repair insurance denials can be frustrating, but understanding the process is key. This comprehensive guide breaks down common reasons behind denials and debunks popular myths. We navigate you through the appeals process, ensuring your rights are protected. Additionally, discover alternative solutions for collision repair coverage beyond traditional insurance. By exploring these options, you’ll find better outcomes and more control over repairing your vehicle.

- Understanding Insurance Denials: Common Causes and Myths Debunked

- Navigating the Appeals Process: Your Rights and Steps to Take

- Alternative Solutions: Options Beyond Insurance for Collision Repair Coverage

Understanding Insurance Denials: Common Causes and Myths Debunked

Collision repair insurance denials can often leave car owners confused and frustrated. Understanding why claims are denied is crucial for navigating the process effectively. Common causes include faulty diagnostics, misalignment in repairs, and failure to use original equipment parts (OEPs). However, many myths surround these denials. For instance, while using certified or aftermarket parts may sometimes be preferred by insurers, it doesn’t automatically lead to a denial. The key is ensuring the repair shop follows industry standards and uses reliable components.

Another common misconception is that frame straightening or car body repair issues always result in denials. In reality, modern diagnostic tools and techniques allow for precise measurements and adjustments, making these processes more accurate than ever before. Insurance companies deny claims when repairs deviate from established guidelines, not because of the technique itself. This clarity can help car owners and repair shops avoid unnecessary stress and ensure a smoother collision repair insurance process.

Navigating the Appeals Process: Your Rights and Steps to Take

Navigating the Appeals Process: Your Rights and Steps to Take

When collision repair insurance denials occur, understanding your rights is essential. As a policyholder, you have the right to appeal and challenge the decision made by your insurer. The appeals process can be complex, but with the right approach, you can advocate for your case effectively. Begin by thoroughly reviewing the denial notice, identifying the specific reasons given for the rejection of your claim. Collect all relevant documents, including estimates from collision repair centers or automotive repair shops, photographs, and any other proof that supports your claim.

Next, prepare a detailed appeal letter addressing each point raised in the denial. Clearly articulate your position, explaining why you believe the initial claim should be covered. If needed, consult with a professional or seek advice from an advocate who specializes in collision repair insurance matters. Present your case with confidence, ensuring that all information is accurate and supported by evidence. Submit your appeal through the appropriate channels, adhering to deadlines specified in your policy or by regulatory bodies overseeing insurance claims.

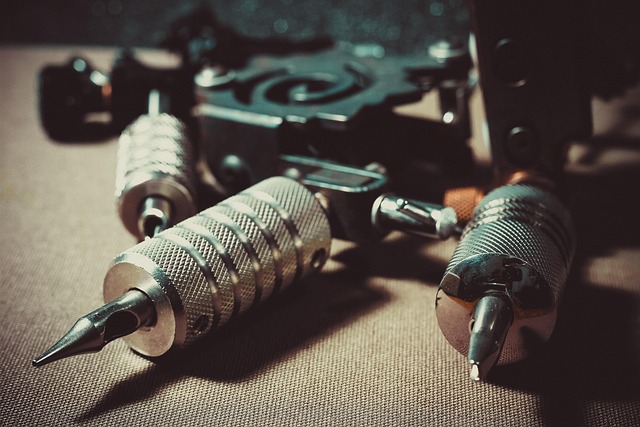

Alternative Solutions: Options Beyond Insurance for Collision Repair Coverage

When collision repair insurance denials occur, many individuals may feel trapped with limited options for fixing their damaged vehicles. However, there exist alternative solutions beyond traditional insurance coverage that can provide relief. One such option is self-funding, where vehicle owners choose to cover the repair costs themselves, which could be feasible if the damage isn’t extensive and budget allowances permit.

Additionally, third-party repair facilities or mobile vehicle body repair services offer cost-effective collision repair alternatives. These businesses often specialize in specific types of repairs, such as car scratch repair or minor dent removal, providing convenient and affordable solutions. Moreover, leveraging online platforms for finding local experts in vehicle repair can help locate skilled technicians who cater to a range of needs, including painting and body work, without relying on insurance claims.

When faced with a collision repair insurance denial, understanding your rights and exploring alternative solutions is crucial. By navigating the appeals process and considering options beyond traditional insurance, you can ensure your vehicle receives the necessary repairs without financial setbacks. Remember, staying informed and proactive is key to finding the best path forward for your collision repair needs.