Collision repair insurance is a critical safety net for auto body shops, covering material and labor costs for various vehicle repairs. Accurate estimates are at the core of this process, ensuring efficient claims processing, customer satisfaction, and trust between insurers and policyholders. By providing upfront, precise cost estimates, insurers streamline claim settlements, encourage repeat business, and strengthen their market position in a competitive industry.

In the complex landscape of collision repair insurance, accurate estimates serve as a cornerstone for success. This article delves into the critical role of precise estimating in managing claims efficiently and enhancing customer satisfaction. By understanding the fundamentals of collision repair insurance and leveraging accurate estimates, insurers can streamline processes, foster trust with policyholders, and drive sustainable business growth. Explore these key aspects to uncover why accurate estimates are indispensable in this dynamic industry.

- Understanding Collision Repair Insurance: A Foundation for Success

- The Role of Accurate Estimates in Claim Processing

- How Precise Estimating Leads to Better Customer Satisfaction and Business Growth

Understanding Collision Repair Insurance: A Foundation for Success

Collision repair insurance is a cornerstone for any successful auto body shop or collision center. It provides financial protection for businesses that specialize in repairing damaged vehicles, ensuring they can deliver high-quality services while mitigating risks. Understanding this type of insurance and its intricacies is essential for maintaining a robust and profitable business in the competitive collision repair services industry.

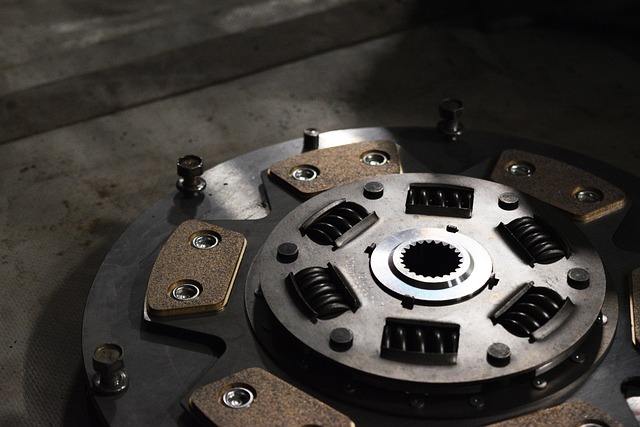

This insurance covers various aspects of car bodywork and auto painting repairs, from material costs to labor expenses. Accurate estimates play a pivotal role here. By meticulously assessing the extent of damage and providing transparent quotes to clients, insurance providers and shop owners can build trust. It allows for better resource allocation, ensuring that every repair job is handled efficiently, within budget, and with top-notch craftsmanship. This foundation of precise estimates and comprehensive coverage fosters a positive reputation for collision repair centers, making them go-to choices for vehicle owners in need of reliable car bodywork and auto painting solutions.

The Role of Accurate Estimates in Claim Processing

Accurate estimates play a pivotal role in the efficient processing of claims for collision repair insurance. When an accident occurs, the initial step involves assessing the damage to the vehicle, which is where precise estimations come into play. These estimates serve as a roadmap, guiding the entire claim journey. By providing a clear picture of the required auto body work and associated costs, they streamline the process, ensuring that policyholders receive timely compensation for the necessary automotive collision repair and auto body painting services.

Furthermore, accurate estimates foster trust between insurance providers and policyholders. When claims are settled quickly based on detailed and correct assessments, it demonstrates a commitment to customer satisfaction. This transparency builds confidence in the company’s ability to handle such situations, ultimately enhancing the overall experience of dealing with collision repair insurance claims for both parties involved, including those requiring auto body work.

How Precise Estimating Leads to Better Customer Satisfaction and Business Growth

Precise estimating is a cornerstone of successful collision repair insurance claims processing. When insurers can provide accurate cost estimates for auto body work, frame straightening, and dent removal services up front, it sets the stage for higher customer satisfaction. Customers appreciate transparency in pricing, knowing exactly what they’ll be paying for before any work begins. This builds trust and fosters strong relationships with insureds, encouraging repeat business and referrals.

Moreover, accurate estimating directly contributes to business growth. By minimizing surprises or overcharges during the claims process, insurers can reduce administrative burdens and optimize resource allocation. This leads to faster claim settlements, allowing policyholders to return to their regular routines more swiftly. Satisfied customers are also more likely to choose the same insurer for future repairs, bolstering the company’s market position in a competitive collision repair insurance landscape.

Accurate estimates are the linchpin of successful collision repair insurance. By streamlining claim processing, enhancing customer satisfaction, and fostering business growth, precise estimating becomes a powerful tool in the automotive industry. Understanding the importance of collision repair insurance and leveraging accurate estimates can lead to a more efficient, profitable, and customer-centric operation.